nanny tax calculator florida

Overview of Florida Taxes. Nanny tax calculator florida Sunday March 20 2022 Edit.

Florida Nanny Tax Rules Poppins Payroll Poppins Payroll

Hourly employees in Florida are entitled to a special overtime pay rate of at least 15 times their.

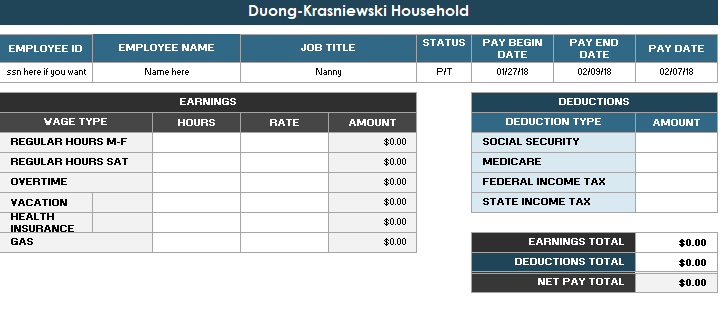

. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Learn all the 2022 household employment rules you need to follow. Guide to Senior Care Taxes and Payroll.

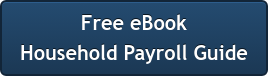

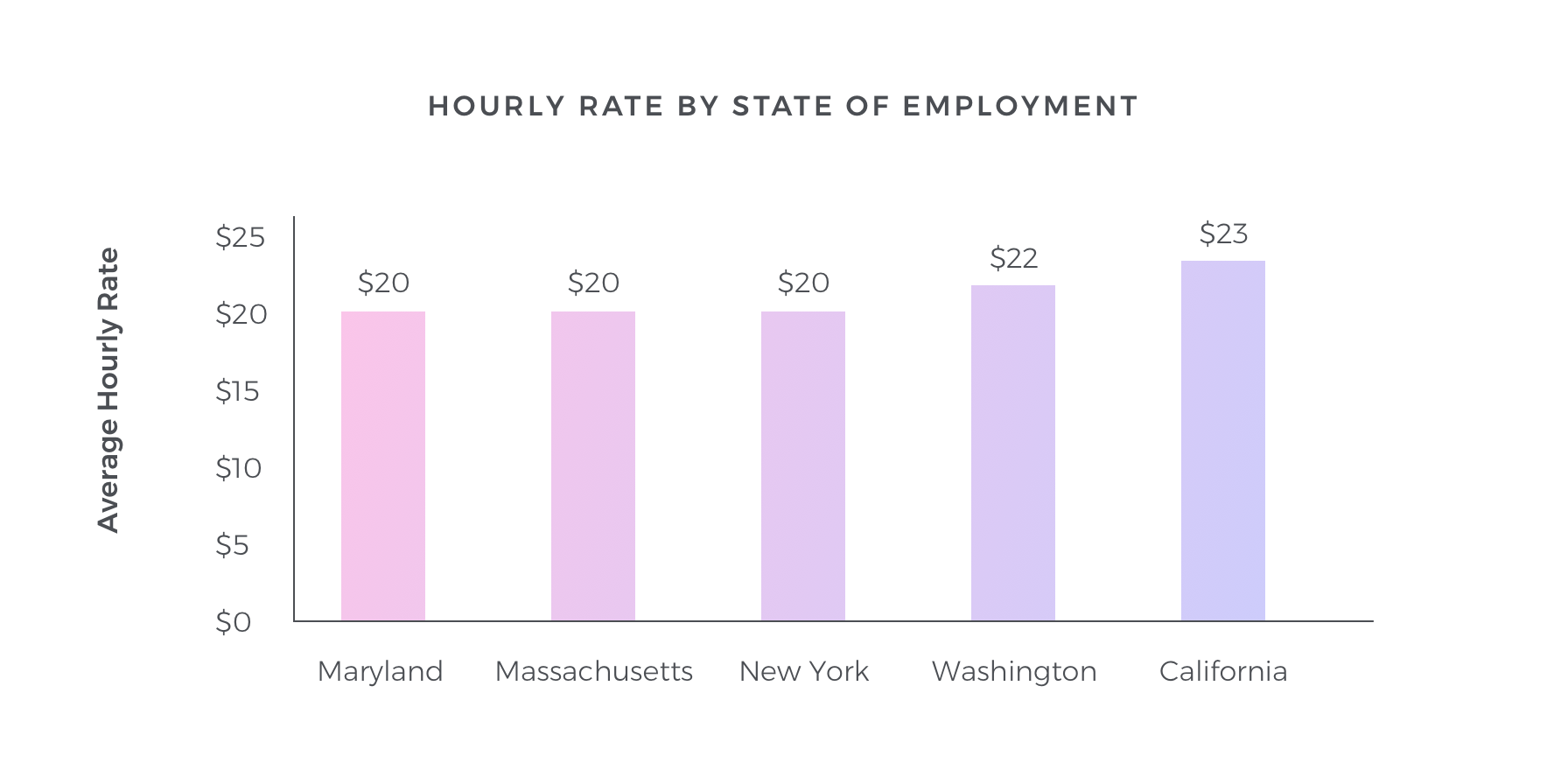

This may vary if you have previous employees. If youre moving to Florida from a state that levies an income. A nanny tax calculator will help you figure out whether the hourly rate youre offering your nanny will net out to a comfortable take-home wage.

Nanny tax calculator florida Wednesday March 16 2022 Edit. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare. Prepare year-end tax documents.

Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. For example if your nanny grosses 800week then your FICA tax for that pay. Simply multiply your nannys gross wages by 765 to get your FICA tax responsibility.

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. Its also helpful for you to see what tax savings. Florida requires a new employer state unemployment insurance tax of 27 for the first 7000 wages paid to each employee.

Send Copy A of Form W-2 to the Social Security Administration. Before you dive in its a good. Complete the required setup paperwork.

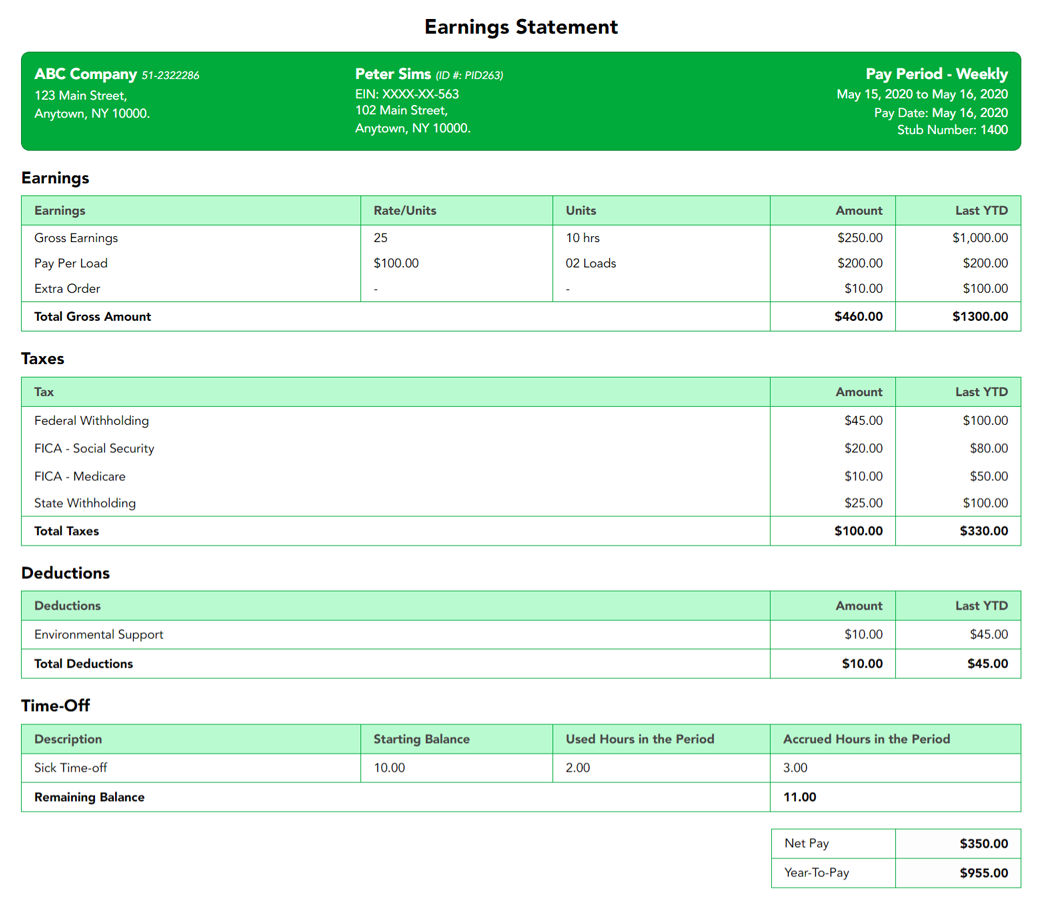

What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll How To Pay Your Nanny S Taxes Yourself. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Send taxes to the IRS and state throughout the year.

It is intended to provide general payroll. These taxes are collectively known as FICA and must be withheld from your nannys pay. Register Nanny Tax Calculators Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees.

If you make 55000 a year living in the region of Florida USA you will be taxed 9076. Calculate payroll each pay period. That means that your net pay will be 45925 per year or 3827 per month.

Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers.

Paying Your Nanny By Law Homework Solutions

Nanny Live Out Salary Comparably

Florida Income Tax Calculator Smartasset

Common Nanny Tax Questions Poppins Payroll Poppins Payroll

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

Free Paystub Generator For Self Employed Individuals

How Much Are The Payroll Taxes In Florida Atlantic Payroll Partners

Nanny Tax Rules And Tax Wage Updates Homework Solutions

Nanny Tax Calculator Gtm Payroll Services Inc

How Much Do I Pay A Nanny Nanny Lane

:max_bytes(150000):strip_icc()/Sure_Payroll-3a112ac5844c452c9bcb4cfda0961376.jpg)

The 7 Best Nanny Payroll Services Of 2022

5 Free Salary Calculator Websites With State Tax Calculations

Florida Nanny Tax Rules Poppins Payroll Poppins Payroll

Florida Paycheck Calculator Smartasset

What Everyone Must Know About A Nanny Tax Calculator